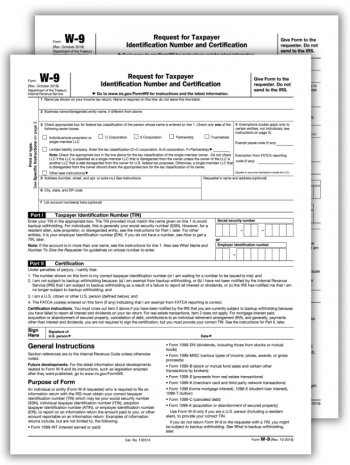

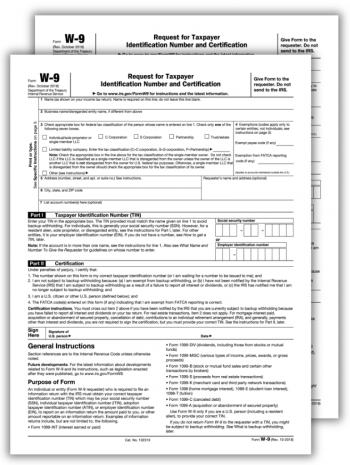

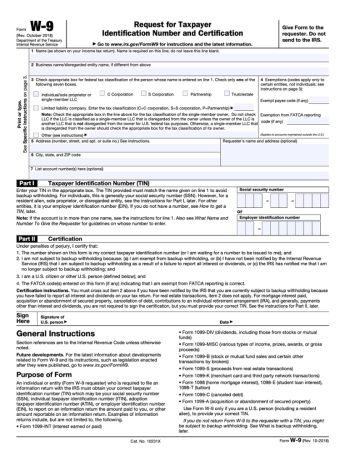

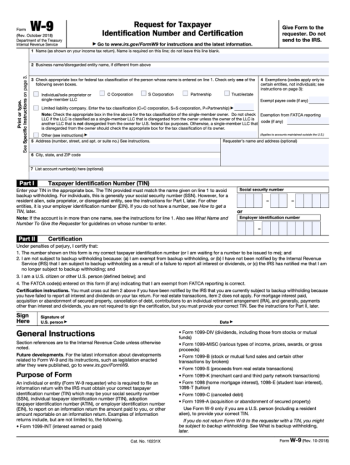

Filling Out The Free W-9 Fillable Form

Starting with a concise explanation, the IRS W-9 Form is utilized by employers to request a taxpayer's identification number and certification. It's a critical document primarily used for self-employed contractors or freelancers. The offeree should aim to fill it accurately to avoid potential penalties. Luckily, on our website, we provide the W-9 fillable for free for ease of completion and submission in 2023.

Features of the W-9 Fillable Form

Now, let's talk about upgrades. The free fillable W9 form for 2023 has improved accessibility and efficiency. It's digitally available for anyone at any time, significantly reducing the time spent on obtaining, filling, and submitting the form. Plus, with a clear structure and predefined fields, it's user-friendly even for a beginner. Users can easily save their progression, making it possible to fill it out in multiple sessions. It's as easy as filling out an online survey!

Fillable W-9 Form & Potential Challenges

While the online W-9 form has its advantages, it has its challenges.

- First, you need a secure and stable internet connection. Any interruption can cause a loss of data and require you to start over.

- Additionally, you must ensure all mandatory fields are correctly filled before submission. Errors can lead to delays or even penalties.

- Lastly, with increasing cyber threats, you must be aware of the risks associated with sharing sensitive information online.

Successful Completion of the W9 in 2023

In order to ensure a successful completion of the free fillable W9 for 2023, you can follow these practical tips. Thoroughly read the instructions provided on the form before you start filling it out. Keep relevant documents, like your social security number, at hand for reference. Double-check each field before moving to the next. Finally, save a copy of the completed form for future reference before submitting. It may be helpful to save it onto your device and print out a physical copy for your records.

Understanding your tax responsibilities and accurately filling out formal documents like the free IRS W-9 fillable form can save you from stress and potentially serious penalties. It's advisable to use the online version of the form while taking the appropriate precautions. Employ these tips next time you need to fill out a W9, and you'll breeze through the process.

Staying ahead of the curve can greatly benefit employers and independent contractors when managing tax documentation. Leveraging the advantages of the free W-9 fillable form in 2023 gives you a significant edge. All this while ensuring compliance with the law and efficient business operations. Never has navigating tax obligations been this straightforward!

Related Forms

-

![image]() W-9 Engaging in financial interactions can feel like wandering through a tangled labyrinth, especially when confronted with paperwork like IRS Form W-9. This document is more manageable than it might first appear; consider Form W-9 to be something like a passport, your contractor's personal identification that the IRS needs to verify their tax situation. Essential for any non-employee service provider or freelancer, the free W-9 form in PDF allows them to provide their Taxpayer Identification Number... Fill Now

W-9 Engaging in financial interactions can feel like wandering through a tangled labyrinth, especially when confronted with paperwork like IRS Form W-9. This document is more manageable than it might first appear; consider Form W-9 to be something like a passport, your contractor's personal identification that the IRS needs to verify their tax situation. Essential for any non-employee service provider or freelancer, the free W-9 form in PDF allows them to provide their Taxpayer Identification Number... Fill Now -

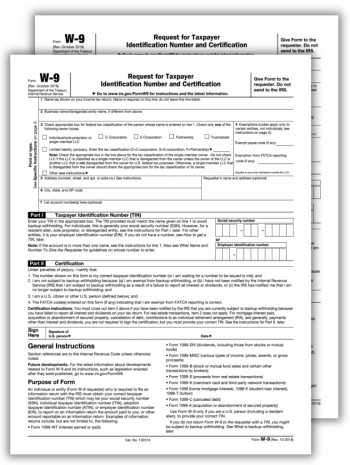

![image]() Free Printable W9 Form With the new fiscal year in the offing, businesses and independent contractors are often faced with timely tax preparation. One of the most pivotal forms to understand and correctly fill out is the W9 form – an inherent cog in the wheel of the IRS taxation mechanism. Designed to ensure proper tax documentation for independent contractors, the free W9 form printable is critical in the fiscal ecosystem. Let's simplify this crucial form for you. The W-9 Printable Form Structure On a surface level, the free printable W9 form looks quite rudimentary, but it has some underlying complexities that need careful attention. The document essentially comprises of vital sections such as the legal name, business name, address, type of business, and the tax ID number and social security number. Each of these factors carries immense weightage in the classification of your tax status, therefore warranting careful completion of each field. Guidelines for Correct W-9 Form Filling Ensure that your name or business name aligns with the IRS records to avoid unforeseen contestations. Pay particular attention to the 'Exempt payee' section. Only indicate this section if it is applicable to your specific situation. Do not leave the TIN section blank. It serves as the pivotal identifier for your tax submission to the IRS. Make sure to sign and date the free printable W9 form for 2023 at the end, otherwise, it will be considered incomplete. Acing the Printable W-9 Form Submission The submission process is relatively straightforward once you've filled out the free W9 printable form accurately. The tax form should be returned directly to the business or individual who requested it from you. A common misconception is that you need to send the request to the IRS, but this is different. You must keep a copy for your records, and the requesting entity will use your information to fill out other necessary IRS forms on your behalf. Deadlines and Delays While the W9 copy does not adhere to a deadline in the conventional sense, like other tax documents, it generally needs to be completed and returned upon request. The business or individual that needs your W9 form typically requires it before you're paid for the first time, so avoid needless delays by filling it out promptly. Awareness and punctuality naturally streamline the process. Remember, a well-filled free printable W9 tax form might seem like a minor accomplishment, but it is an indispensable part of the tax process. Timely, meticulous, and accurate form filling will make the tax season less daunting and more manageable. Fill Now

Free Printable W9 Form With the new fiscal year in the offing, businesses and independent contractors are often faced with timely tax preparation. One of the most pivotal forms to understand and correctly fill out is the W9 form – an inherent cog in the wheel of the IRS taxation mechanism. Designed to ensure proper tax documentation for independent contractors, the free W9 form printable is critical in the fiscal ecosystem. Let's simplify this crucial form for you. The W-9 Printable Form Structure On a surface level, the free printable W9 form looks quite rudimentary, but it has some underlying complexities that need careful attention. The document essentially comprises of vital sections such as the legal name, business name, address, type of business, and the tax ID number and social security number. Each of these factors carries immense weightage in the classification of your tax status, therefore warranting careful completion of each field. Guidelines for Correct W-9 Form Filling Ensure that your name or business name aligns with the IRS records to avoid unforeseen contestations. Pay particular attention to the 'Exempt payee' section. Only indicate this section if it is applicable to your specific situation. Do not leave the TIN section blank. It serves as the pivotal identifier for your tax submission to the IRS. Make sure to sign and date the free printable W9 form for 2023 at the end, otherwise, it will be considered incomplete. Acing the Printable W-9 Form Submission The submission process is relatively straightforward once you've filled out the free W9 printable form accurately. The tax form should be returned directly to the business or individual who requested it from you. A common misconception is that you need to send the request to the IRS, but this is different. You must keep a copy for your records, and the requesting entity will use your information to fill out other necessary IRS forms on your behalf. Deadlines and Delays While the W9 copy does not adhere to a deadline in the conventional sense, like other tax documents, it generally needs to be completed and returned upon request. The business or individual that needs your W9 form typically requires it before you're paid for the first time, so avoid needless delays by filling it out promptly. Awareness and punctuality naturally streamline the process. Remember, a well-filled free printable W9 tax form might seem like a minor accomplishment, but it is an indispensable part of the tax process. Timely, meticulous, and accurate form filling will make the tax season less daunting and more manageable. Fill Now -

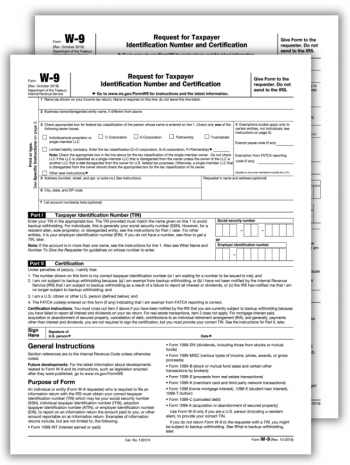

![image]() Free W9 Form for 2023 The concept of taxes can often seem tangled in a web of complexity. But, like any enigma, it unravels when taken one step at a time. A good starting point is understanding Form W-9, an essential document in the US tax scheme. In this article, we will explore the ins and outs of the W9 form for 2023 for free. Terms for the W-9 Tax Form Usage Anyone can find themselves in an unusual circumstance requiring a free W9 form in 2023 or any other year. Imagine this: you are an independent contractor jazzed about a new project. The client is thrilled with your work and ready to sign the paycheck. But wait, they need your Form W-9, which must be the current document for 2023. It’s a classic case of why you have to stay ahead of the game by being prepared! Another instance is if you enlisted the services of a housekeeper. You must report the payments to the IRS to ensure everything stays above board. You will need your housekeeper's Form W-9 to do that. Fix the W-9 Form Errors Like a Pro Sometimes, you may encounter hiccups during your tax submission process. For instance, you've already submitted the Form W-9 to a client, and you realize there's an error. It's like sending a text with a glaring typo – you wish you could retract it! Fret not; you can quickly correct the error by filling out and submitting a new Form W-9 with the correct information. Remember, it's always better to set things right rather than hope the initial oversight goes unnoticed. IRS W-9 Form for 2023: Your Quick FAQ Guide We present you three essential questions that often arise about the free printable W-9 form in 2023: What should I do if I lose my Form W-9?Don't panic! You can always get a free printable 2023 W-9 form directly from our website in a couple of clicks. How often should I update my Form W-9?Whenever your information changes, e.g., a change in address or marital status, you should promptly update your form. Can I submit a Form W-9 from a previous year?It depends. The IRS doesn't update the template annually, so the free W-9 for 2023 looks the same as in 2022 or 2021. But keep an eye out for the new version when it comes. Understanding tax forms is like assembling a puzzle – the pieces may seem convoluted at first glance, but with time and patience, everything fits together. Grasping the essence of complex tax forms such as Form W-9 is a significant stride in mastering the art of taxes. We hope this guide lights your path as you navigate the fascinating world of tax forms. Fill Now

Free W9 Form for 2023 The concept of taxes can often seem tangled in a web of complexity. But, like any enigma, it unravels when taken one step at a time. A good starting point is understanding Form W-9, an essential document in the US tax scheme. In this article, we will explore the ins and outs of the W9 form for 2023 for free. Terms for the W-9 Tax Form Usage Anyone can find themselves in an unusual circumstance requiring a free W9 form in 2023 or any other year. Imagine this: you are an independent contractor jazzed about a new project. The client is thrilled with your work and ready to sign the paycheck. But wait, they need your Form W-9, which must be the current document for 2023. It’s a classic case of why you have to stay ahead of the game by being prepared! Another instance is if you enlisted the services of a housekeeper. You must report the payments to the IRS to ensure everything stays above board. You will need your housekeeper's Form W-9 to do that. Fix the W-9 Form Errors Like a Pro Sometimes, you may encounter hiccups during your tax submission process. For instance, you've already submitted the Form W-9 to a client, and you realize there's an error. It's like sending a text with a glaring typo – you wish you could retract it! Fret not; you can quickly correct the error by filling out and submitting a new Form W-9 with the correct information. Remember, it's always better to set things right rather than hope the initial oversight goes unnoticed. IRS W-9 Form for 2023: Your Quick FAQ Guide We present you three essential questions that often arise about the free printable W-9 form in 2023: What should I do if I lose my Form W-9?Don't panic! You can always get a free printable 2023 W-9 form directly from our website in a couple of clicks. How often should I update my Form W-9?Whenever your information changes, e.g., a change in address or marital status, you should promptly update your form. Can I submit a Form W-9 from a previous year?It depends. The IRS doesn't update the template annually, so the free W-9 for 2023 looks the same as in 2022 or 2021. But keep an eye out for the new version when it comes. Understanding tax forms is like assembling a puzzle – the pieces may seem convoluted at first glance, but with time and patience, everything fits together. Grasping the essence of complex tax forms such as Form W-9 is a significant stride in mastering the art of taxes. We hope this guide lights your path as you navigate the fascinating world of tax forms. Fill Now -

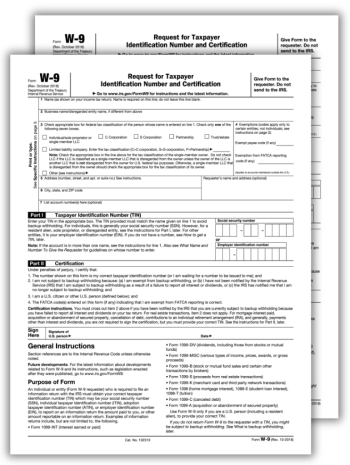

![image]() Free W-9 Tax Form Wading through the labyrinth of US tax forms can be daunting, but understanding the right form to use can make a world of difference to your pocket. One such example is the W-9 tax form. The Basics of the W-9 Tax Form The Internal Revenue Service (IRS) designed the free printable W-9 tax form for self-employed people in the USA. It's employed by third parties who contract your services, such as employers, banks, or other financial institutions. The information supplied on this form, including taxpayer identification number, name, and address, is used to prepare form 1099, which documents income received from various sources other than wages, salaries, and tips. Key Updates in the W9 Tax Form Since the last IRS revision in October 2018, the W9 tax form is free and has not had significant modifications. However, it's crucial to stay updated about any changes that affect this tax form since they might influence how you fill in your details. Are You Eligible to Use the Free W9 Tax Form? The good news is that the W-9 tax form is free and available for use by all U.S. persons, including individuals and entities such as corporations, partnerships, and trusts. It's generally used by independent contractors, freelancers, or self-employed individuals who offer their services to businesses. However, it's not applicable for employees who receive a regular salary, as they fill out a W-4 copy instead. Cutting Your Tax Bill Effortlessly Taxes can be overwhelming for the untrained eye. However, knowing about deductions and credits for which you are eligible will help to cut your tax bill. Completing the free W9 tax form can be the first step in this process. It can help you get started on claiming these deductions. W-9 vs. W-8 The W-9 and W-8 forms are tax-related documents used in the United States but serve different purposes for different individuals or entities. The W-9 form is used by U.S. citizens, residents, and certain businesses to provide their taxpayer identification number (TIN) to requesters, typically for reporting income subject to U.S. taxation. Conversely, the W-8 series forms are for non-U.S. individuals or foreign entities, enabling them to declare their foreign status, claim treaty benefits, and avoid excessive U.S. tax withholding. In essence, W-9 collects U.S. taxpayer information, while W-8 forms capture foreign status information for tax withholding exemptions or reductions. Summing It All Up So the next time you're contracted for a service, remember the free W-9 tax form is necessary to satisfy IRS tax reporting requirements. Remember, you must provide accurate information on the form to prevent potential backup withholding for your payments. For further details or questions, always consult a reliable tax advisor. Fill Now

Free W-9 Tax Form Wading through the labyrinth of US tax forms can be daunting, but understanding the right form to use can make a world of difference to your pocket. One such example is the W-9 tax form. The Basics of the W-9 Tax Form The Internal Revenue Service (IRS) designed the free printable W-9 tax form for self-employed people in the USA. It's employed by third parties who contract your services, such as employers, banks, or other financial institutions. The information supplied on this form, including taxpayer identification number, name, and address, is used to prepare form 1099, which documents income received from various sources other than wages, salaries, and tips. Key Updates in the W9 Tax Form Since the last IRS revision in October 2018, the W9 tax form is free and has not had significant modifications. However, it's crucial to stay updated about any changes that affect this tax form since they might influence how you fill in your details. Are You Eligible to Use the Free W9 Tax Form? The good news is that the W-9 tax form is free and available for use by all U.S. persons, including individuals and entities such as corporations, partnerships, and trusts. It's generally used by independent contractors, freelancers, or self-employed individuals who offer their services to businesses. However, it's not applicable for employees who receive a regular salary, as they fill out a W-4 copy instead. Cutting Your Tax Bill Effortlessly Taxes can be overwhelming for the untrained eye. However, knowing about deductions and credits for which you are eligible will help to cut your tax bill. Completing the free W9 tax form can be the first step in this process. It can help you get started on claiming these deductions. W-9 vs. W-8 The W-9 and W-8 forms are tax-related documents used in the United States but serve different purposes for different individuals or entities. The W-9 form is used by U.S. citizens, residents, and certain businesses to provide their taxpayer identification number (TIN) to requesters, typically for reporting income subject to U.S. taxation. Conversely, the W-8 series forms are for non-U.S. individuals or foreign entities, enabling them to declare their foreign status, claim treaty benefits, and avoid excessive U.S. tax withholding. In essence, W-9 collects U.S. taxpayer information, while W-8 forms capture foreign status information for tax withholding exemptions or reductions. Summing It All Up So the next time you're contracted for a service, remember the free W-9 tax form is necessary to satisfy IRS tax reporting requirements. Remember, you must provide accurate information on the form to prevent potential backup withholding for your payments. For further details or questions, always consult a reliable tax advisor. Fill Now -

![image]() Free IRS W-9 Form If you're engaging in freelance work, you're no stranger to the many forms needed to keep your business operations running smoothly. One of the critical documents you must familiarize yourself with is the IRS W-9 form. Simply put, the W-9 form is sent by the entity or person paying for your freelance services. This document is an integral part of the tax reporting process, allowing your clients to correctly report the amount they've paid you. The key information outlined in the free printable IRS W-9 form is your taxpayer identification number (TIN), which could either be your social security number (SSN) or employer identification number (EIN). This simple yet essential document is a key player in maintaining your tax compliance. A Step Closer to Printable IRS W-9 Form In the past, you likely had to request a W-9 form from the IRS or your local tax office, followed by a tedious cycle of printing, filling, and mailing. Thanks to technology, you can now access the free printable IRS W9 form with just a few mouse clicks. Not only does going digital save you time, but it also reduces the risk of losing crucial paperwork. We'll delve into the filling process momentarily. W9 Online: Guide to Complete the Form Firstly, navigate to our website and download your free IRS W9 online form as a PDF. Once you're set, you must complete all fields, providing accurate details for your TIN, name, and business name if it is different from your personal name. If you have a limited liability company (LLC), you must also specify the tax classification. Lastly, remember to print your full name again, append your signature, and write the date. Remember, honesty plays a crucial role here. Providing inaccurate information can lead to penalty charges or even legal prosecution. It's always best practice to double-check your details before submission. Benefit from the IRS W-9 Fillable Form One of the great conveniences of the digital era is fillable forms. The best feature is that the free IRS W-9 fillable form lets you input your details online. It eliminates the need to print and handwrite your information. This method is not only faster but also reduces handwriting-related errors. Once filled, you can email the completed form to your client, creating a seamless work process. Your Companion, the Free W-9 Form To sum up, the W-9 form is your freelance work's silent companion, a non-negotiable part of your tax compliance. Though it might seem like mere paperwork at the start, it is important not to diminish its significance. By mastering all aspects of a free IRS W-9 form, from understanding its purpose to knowing how to fill it out, you cloak your freelance operation with an extra layer of tax compliance and professional integrity. Expand your knowledge further with additional financial articles, and simplify your journey to successful entrepreneurship! Fill Now

Free IRS W-9 Form If you're engaging in freelance work, you're no stranger to the many forms needed to keep your business operations running smoothly. One of the critical documents you must familiarize yourself with is the IRS W-9 form. Simply put, the W-9 form is sent by the entity or person paying for your freelance services. This document is an integral part of the tax reporting process, allowing your clients to correctly report the amount they've paid you. The key information outlined in the free printable IRS W-9 form is your taxpayer identification number (TIN), which could either be your social security number (SSN) or employer identification number (EIN). This simple yet essential document is a key player in maintaining your tax compliance. A Step Closer to Printable IRS W-9 Form In the past, you likely had to request a W-9 form from the IRS or your local tax office, followed by a tedious cycle of printing, filling, and mailing. Thanks to technology, you can now access the free printable IRS W9 form with just a few mouse clicks. Not only does going digital save you time, but it also reduces the risk of losing crucial paperwork. We'll delve into the filling process momentarily. W9 Online: Guide to Complete the Form Firstly, navigate to our website and download your free IRS W9 online form as a PDF. Once you're set, you must complete all fields, providing accurate details for your TIN, name, and business name if it is different from your personal name. If you have a limited liability company (LLC), you must also specify the tax classification. Lastly, remember to print your full name again, append your signature, and write the date. Remember, honesty plays a crucial role here. Providing inaccurate information can lead to penalty charges or even legal prosecution. It's always best practice to double-check your details before submission. Benefit from the IRS W-9 Fillable Form One of the great conveniences of the digital era is fillable forms. The best feature is that the free IRS W-9 fillable form lets you input your details online. It eliminates the need to print and handwrite your information. This method is not only faster but also reduces handwriting-related errors. Once filled, you can email the completed form to your client, creating a seamless work process. Your Companion, the Free W-9 Form To sum up, the W-9 form is your freelance work's silent companion, a non-negotiable part of your tax compliance. Though it might seem like mere paperwork at the start, it is important not to diminish its significance. By mastering all aspects of a free IRS W-9 form, from understanding its purpose to knowing how to fill it out, you cloak your freelance operation with an extra layer of tax compliance and professional integrity. Expand your knowledge further with additional financial articles, and simplify your journey to successful entrepreneurship! Fill Now -

![image]() Free W9 Online Form Technology has come to revolutionize many aspects of our lives, and taxation is not left behind. If you have ever wondered if you can fill out a W9 online for free, the simple answer is yes. The digital transformation of the W-9 form signifies the advent of a simpler, faster, and more efficient taxation process. Free W9 Online Form: Beyond Paper and Pen The conventional way to fill out W9 online for free involves downloading the document, printing it out, manually filling in the details, signing it, and mailing it. This process, though effective, was fraught with challenges, including delays due to postal inefficiencies and the risk of form misplacement. Now, you can take advantage of filling out a W9 form online. The electronic W-9 eliminates the need for physical mailing and significantly reduces the chances of losing your copy. Unlocking Efficiency with the Free W-9 Online Form Online submission of the W-9 form is about more than just convenience. It paves the way for increased accuracy during the transcription process. With the free W-9 form online, you no longer have to worry about legibility issues with handwriting the sample. Also, electronic forms often come with checks that ensure all mandatory fields are filled out effectively, thereby minimizing mistakes. A Safe Haven: e-Signing the W-9 Form Hassle-Free E-signature technology is one of the key driving forces behind the online improvisation of the W-9 request. With the increased acceptance of electronic signatures legally, you can now safely and securely e-sign your W-9 form online for free in a few clicks. This capability elegantly ties to the overall benefit of convenience and speed that comes with the electronic W-9 template. It eliminates the need for a physical signature, speeding up the process even more. Busting the Myths Some individuals have expressed concerns about the potential security risks that might arise when filling out a W9 online form for free. This is a valid concern considering the sensitive personal information required in the form, such as Social Security and Employer Identification Numbers. However, credible online tax service providers have robust security measures to protect your data. They use advanced encryption technologies to ensure your information is safe during transmission and storage. With the significant benefits of speed, convenience, and accuracy, the fillable W-9 form is a welcome shift in taxation. If you still need to use the W9 form online for free, now is the time to embrace this innovative and efficient tax reporting method. Fill Now

Free W9 Online Form Technology has come to revolutionize many aspects of our lives, and taxation is not left behind. If you have ever wondered if you can fill out a W9 online for free, the simple answer is yes. The digital transformation of the W-9 form signifies the advent of a simpler, faster, and more efficient taxation process. Free W9 Online Form: Beyond Paper and Pen The conventional way to fill out W9 online for free involves downloading the document, printing it out, manually filling in the details, signing it, and mailing it. This process, though effective, was fraught with challenges, including delays due to postal inefficiencies and the risk of form misplacement. Now, you can take advantage of filling out a W9 form online. The electronic W-9 eliminates the need for physical mailing and significantly reduces the chances of losing your copy. Unlocking Efficiency with the Free W-9 Online Form Online submission of the W-9 form is about more than just convenience. It paves the way for increased accuracy during the transcription process. With the free W-9 form online, you no longer have to worry about legibility issues with handwriting the sample. Also, electronic forms often come with checks that ensure all mandatory fields are filled out effectively, thereby minimizing mistakes. A Safe Haven: e-Signing the W-9 Form Hassle-Free E-signature technology is one of the key driving forces behind the online improvisation of the W-9 request. With the increased acceptance of electronic signatures legally, you can now safely and securely e-sign your W-9 form online for free in a few clicks. This capability elegantly ties to the overall benefit of convenience and speed that comes with the electronic W-9 template. It eliminates the need for a physical signature, speeding up the process even more. Busting the Myths Some individuals have expressed concerns about the potential security risks that might arise when filling out a W9 online form for free. This is a valid concern considering the sensitive personal information required in the form, such as Social Security and Employer Identification Numbers. However, credible online tax service providers have robust security measures to protect your data. They use advanced encryption technologies to ensure your information is safe during transmission and storage. With the significant benefits of speed, convenience, and accuracy, the fillable W-9 form is a welcome shift in taxation. If you still need to use the W9 form online for free, now is the time to embrace this innovative and efficient tax reporting method. Fill Now -

![image]() Free W-9 Form in PDF As a small business owner, navigating tax compliance may seem daunting. The IRS tax forms demand exact precision, and the slightest error can lead to complications. One critical document you must understand is the W-9 form. It is an information return that allows business owners to report certain types of payments made to the IRS. For instance, you may need to send a W-9 form to a freelancer you have contracted to work for your company. The data contained within the form aids the IRS in tracking income that may be subject to taxes. How to Access a Free W-9 Form as PDF Making tax processes easier, our website provides a free W9 form in PDF format for download and online usage. Instead of going through the hassle of paper forms, you can easily download and print them as needed. To ensure streamlined processing, be sure that Adobe Acrobat is installed on your system. This will allow you to view and print the PDF file correctly. While downloading, always cross-check the source for authenticity. Remember, our website provides legitimate, free versions of the form. Fill out a W9 Form Properly Once you have accessed your free W9 in PDF, you must correctly fill it out. It requests basic information like name, address, and Social Security Number. For businesses, you should provide your Employer Identification Number. Make sure everything you enter is accurate and properly spelled. Mistakes can result in delays or incorrect filing. Business NameUse the same legal name you filed during your business registration. It should match the records with the IRS. Check Appropriate Federal Tax ClassificationTick the box corresponding to your business structure (Individual/Sole Proprietor, C Corporation, S Corporation, Partnership, Trust/estate, Limited liability company). AddressFurnish the accurate postal address for your business. It could be a home, office, or PO Box address. Taxpayer Identification NumberInput your correct Social Security Number (SSN) or Employer Identification Number (EIN). Importance of Keeping W-9s on File Once you collect a completed and signed W-9 from a contractor, you should keep it on file. This is important because if the IRS ever audits your business or if there are discrepancies with your contractor or vendor's reported income, you will need these forms for proof of correspondence. Becoming acquainted with tax forms and procedures signifies a major milestone in your entrepreneurial journey. While it might initially seem intimidating, understanding how to handle forms like the W-9 can considerably simplify your tax matters. So download your free W9 form in PDF now and take the first step toward stress-free tax compliance. Fill Now

Free W-9 Form in PDF As a small business owner, navigating tax compliance may seem daunting. The IRS tax forms demand exact precision, and the slightest error can lead to complications. One critical document you must understand is the W-9 form. It is an information return that allows business owners to report certain types of payments made to the IRS. For instance, you may need to send a W-9 form to a freelancer you have contracted to work for your company. The data contained within the form aids the IRS in tracking income that may be subject to taxes. How to Access a Free W-9 Form as PDF Making tax processes easier, our website provides a free W9 form in PDF format for download and online usage. Instead of going through the hassle of paper forms, you can easily download and print them as needed. To ensure streamlined processing, be sure that Adobe Acrobat is installed on your system. This will allow you to view and print the PDF file correctly. While downloading, always cross-check the source for authenticity. Remember, our website provides legitimate, free versions of the form. Fill out a W9 Form Properly Once you have accessed your free W9 in PDF, you must correctly fill it out. It requests basic information like name, address, and Social Security Number. For businesses, you should provide your Employer Identification Number. Make sure everything you enter is accurate and properly spelled. Mistakes can result in delays or incorrect filing. Business NameUse the same legal name you filed during your business registration. It should match the records with the IRS. Check Appropriate Federal Tax ClassificationTick the box corresponding to your business structure (Individual/Sole Proprietor, C Corporation, S Corporation, Partnership, Trust/estate, Limited liability company). AddressFurnish the accurate postal address for your business. It could be a home, office, or PO Box address. Taxpayer Identification NumberInput your correct Social Security Number (SSN) or Employer Identification Number (EIN). Importance of Keeping W-9s on File Once you collect a completed and signed W-9 from a contractor, you should keep it on file. This is important because if the IRS ever audits your business or if there are discrepancies with your contractor or vendor's reported income, you will need these forms for proof of correspondence. Becoming acquainted with tax forms and procedures signifies a major milestone in your entrepreneurial journey. While it might initially seem intimidating, understanding how to handle forms like the W-9 can considerably simplify your tax matters. So download your free W9 form in PDF now and take the first step toward stress-free tax compliance. Fill Now -

![image]() Free Blank W-9 Form Regarding tax documentation, one form that often induces confusion is the W-9 request. Efficiently comprehending its purpose and knowing when to use this form can significantly simplify tax-related processes. The Purpose And Usage Of The W-9 Form Juridically, the free blank W-9 form is known as the Request for Taxpayer Identification Number and Certification. Essentially, it is used for confirming an individual's tax ID number. It is particularly submitted to entities that will pay you income during the tax year. For instance, independent contractors use free blank W9 forms to share their tax ID numbers with clients. Key Elements Of The W-9 Form The W-9 form, although relatively straightforward, requires some carefulness to ensure accurate completion. The critical components to consider include: Name and business nameEnsure your name aligns with how it appears on your tax return. Taxpayer Identification Number (TIN)Typically, this is your Social Security Number (SSN) or Employer Identification Number (EIN). Status of the taxpayerDescribe whether you are operating as an individual, corporation, partnership, etc. The W-9 Form: Common Mistakes & Solutions Despite the form’s apparent simplicity, it is common for individuals to make errors when filling out their free printable blank W-9 form. Some of the common pitfalls include: Mismatched name and TINThis can lead to backup withholding. As a solution, double-check to confirm that your name and TIN align with those on your tax return. Inaccurate taxpayer statusThe IRS treats individual taxpayers and business entities differently. Ensure you have accurately outlined your status to avoid any miscommunication. Exceptions for IRS W-9 Tax Form Usage Individuals or entities cannot use the W-9 tax form if they are not U.S. citizens, residents, or domestic entities for tax purposes. Exemptions include non-resident aliens, foreign individuals or businesses, and certain tax-exempt organizations. Non-resident aliens typically use the W-8 series forms to declare their foreign status, claim treaty benefits, or establish eligibility for reduced tax withholding. Additionally, individuals without a valid taxpayer identification number (TIN) or Social Security Number (SSN) are ineligible for the W-9 form. Properly filling out the form ensures smoother transactions and avoids complications with the IRS. Also, the free printable blank W9 form is readily available and user-friendly. Knowledge and caution significantly simplify all processes! Fill Now

Free Blank W-9 Form Regarding tax documentation, one form that often induces confusion is the W-9 request. Efficiently comprehending its purpose and knowing when to use this form can significantly simplify tax-related processes. The Purpose And Usage Of The W-9 Form Juridically, the free blank W-9 form is known as the Request for Taxpayer Identification Number and Certification. Essentially, it is used for confirming an individual's tax ID number. It is particularly submitted to entities that will pay you income during the tax year. For instance, independent contractors use free blank W9 forms to share their tax ID numbers with clients. Key Elements Of The W-9 Form The W-9 form, although relatively straightforward, requires some carefulness to ensure accurate completion. The critical components to consider include: Name and business nameEnsure your name aligns with how it appears on your tax return. Taxpayer Identification Number (TIN)Typically, this is your Social Security Number (SSN) or Employer Identification Number (EIN). Status of the taxpayerDescribe whether you are operating as an individual, corporation, partnership, etc. The W-9 Form: Common Mistakes & Solutions Despite the form’s apparent simplicity, it is common for individuals to make errors when filling out their free printable blank W-9 form. Some of the common pitfalls include: Mismatched name and TINThis can lead to backup withholding. As a solution, double-check to confirm that your name and TIN align with those on your tax return. Inaccurate taxpayer statusThe IRS treats individual taxpayers and business entities differently. Ensure you have accurately outlined your status to avoid any miscommunication. Exceptions for IRS W-9 Tax Form Usage Individuals or entities cannot use the W-9 tax form if they are not U.S. citizens, residents, or domestic entities for tax purposes. Exemptions include non-resident aliens, foreign individuals or businesses, and certain tax-exempt organizations. Non-resident aliens typically use the W-8 series forms to declare their foreign status, claim treaty benefits, or establish eligibility for reduced tax withholding. Additionally, individuals without a valid taxpayer identification number (TIN) or Social Security Number (SSN) are ineligible for the W-9 form. Properly filling out the form ensures smoother transactions and avoids complications with the IRS. Also, the free printable blank W9 form is readily available and user-friendly. Knowledge and caution significantly simplify all processes! Fill Now -

![image]() Free W9 Form for Download If you are an independent contractor, a freelancer, or a sole proprietor who provides some service, one of the most important documents you'll encounter is the W-9 tax form. This form, the Request for Taxpayer Identification Number and Certification, is critical to complying with tax laws while conducting business. Fortunately, it is easy for free download the W-9 tax form provided on our website. In this article, we'll provide a clear guide on finding, downloading, and understanding the W-9 tax form. Read on to easily navigate your tax obligations. Downloading Your W-9 Tax Form To begin, you'll need to find a webpage with a W9 form for free download, so scroll to the top of the screen. From there, find the "Get Form" button — a user-friendly feature we've created to save you time. Click on this button to open the W-9 template in the PDF editor. Once you've located the free W9 form for download, you'll notice it is available in PDF format. This is the ideal format, as it is universally compatible with most, if not all, computer systems. To begin the downloading process, click on the arrow button located near the form. Having chosen the file you wish to download, you're set to move forward. A new window will pop up, prompting you to select the location in your device where you want to store the file. After you've selected an appropriate location, the downloading process will start. It's necessary to note that PDF files are usually small and will only take a few seconds to download. So you need not worry about waiting an eternity before accessing your form. However, the downloading speed might vary based on internet connection and device capability. Filling Out Your W-9 Form Now that you have your W-9 template, you can begin filling it out. This request is simple and straightforward, and it should only take a while to complete it. However, if you need help understanding the required fields and anonymity associated with the document, we have a support system ready to assist. You can also seek the advice of a tax advisor. Obtaining, downloading, and understanding your W-9 form doesn’t have to be a painstaking process. With our platform offering a free for download W-9 form, you can complete your tax obligations faster and more efficiently. With our easy-to-navigate platform, downloading and filling in your W-9 copy is a breeze. So why wait? Start the tax filing process today by downloading your free W-9 form. Remember, an early start means less stress and more time to focus on what matters the most – your business. Fill Now

Free W9 Form for Download If you are an independent contractor, a freelancer, or a sole proprietor who provides some service, one of the most important documents you'll encounter is the W-9 tax form. This form, the Request for Taxpayer Identification Number and Certification, is critical to complying with tax laws while conducting business. Fortunately, it is easy for free download the W-9 tax form provided on our website. In this article, we'll provide a clear guide on finding, downloading, and understanding the W-9 tax form. Read on to easily navigate your tax obligations. Downloading Your W-9 Tax Form To begin, you'll need to find a webpage with a W9 form for free download, so scroll to the top of the screen. From there, find the "Get Form" button — a user-friendly feature we've created to save you time. Click on this button to open the W-9 template in the PDF editor. Once you've located the free W9 form for download, you'll notice it is available in PDF format. This is the ideal format, as it is universally compatible with most, if not all, computer systems. To begin the downloading process, click on the arrow button located near the form. Having chosen the file you wish to download, you're set to move forward. A new window will pop up, prompting you to select the location in your device where you want to store the file. After you've selected an appropriate location, the downloading process will start. It's necessary to note that PDF files are usually small and will only take a few seconds to download. So you need not worry about waiting an eternity before accessing your form. However, the downloading speed might vary based on internet connection and device capability. Filling Out Your W-9 Form Now that you have your W-9 template, you can begin filling it out. This request is simple and straightforward, and it should only take a while to complete it. However, if you need help understanding the required fields and anonymity associated with the document, we have a support system ready to assist. You can also seek the advice of a tax advisor. Obtaining, downloading, and understanding your W-9 form doesn’t have to be a painstaking process. With our platform offering a free for download W-9 form, you can complete your tax obligations faster and more efficiently. With our easy-to-navigate platform, downloading and filling in your W-9 copy is a breeze. So why wait? Start the tax filing process today by downloading your free W-9 form. Remember, an early start means less stress and more time to focus on what matters the most – your business. Fill Now -

![image]() Form W-9: Top 10 Common Mistakes The Internal Revenue Service's (IRS) Form W-9 is widely used in business transactions as a request for a person's or entity's taxpayer identification number (TIN). Proper completion of this form is crucial to avoid issues and penalties. However, several common mistakes are often made during this process. Below, we've highlighted the top 10 pitfalls to avoid when filling out your W-9 form. Incorrect TINOne of the most common mistakes is an incorrect or missing Taxpayer Identification Number. Ensure that the number you enter is correct and corresponds with your correct legal name on file with the IRS. Incorrect NameAnother common mistake is the use of a nickname or alias instead of a legal name. Ensure you provide the correct legal name on your income tax return. Omitting a Business Nameif completing the form for business purposes, do not forget to include the business name on the "Business Name" line to ensure accuracy. Choosing the Wrong Business EntityIt is crucial to correctly identify your tax classification type, whether you’re an individual (sole proprietor), corporation, or exempt payee. Not Signing or Dating the FormRemember to sign and date the form, as any form without a signature is invalid. Incorrect AddressProviding an incorrect address may cause significant delays in processing paperwork. Always crosscheck to ensure the address you've provided is accurate. Choosing Wrong ExemptionEnsure that you understand all the exemption options before you make the wrong choice that leads to incorrect payments of taxes. Leaving Any Part UnfilledEvery section of the W-9 form is crucial. Leaving out any part incomplete may invalidate the whole process. Providing Incorrect Contact InformationEnsure your phone number and email address are accurate to avoid communication issues with your employer or the IRS. Not Keeping a CopyAlways ensure that you keep a copy of the form for future reference or in case of audit. To conclude, always double-check your W-9 form before submitting it. Seeing a tax professional for help if you're unsure about any part of the form is also a good idea. Fill Now

Form W-9: Top 10 Common Mistakes The Internal Revenue Service's (IRS) Form W-9 is widely used in business transactions as a request for a person's or entity's taxpayer identification number (TIN). Proper completion of this form is crucial to avoid issues and penalties. However, several common mistakes are often made during this process. Below, we've highlighted the top 10 pitfalls to avoid when filling out your W-9 form. Incorrect TINOne of the most common mistakes is an incorrect or missing Taxpayer Identification Number. Ensure that the number you enter is correct and corresponds with your correct legal name on file with the IRS. Incorrect NameAnother common mistake is the use of a nickname or alias instead of a legal name. Ensure you provide the correct legal name on your income tax return. Omitting a Business Nameif completing the form for business purposes, do not forget to include the business name on the "Business Name" line to ensure accuracy. Choosing the Wrong Business EntityIt is crucial to correctly identify your tax classification type, whether you’re an individual (sole proprietor), corporation, or exempt payee. Not Signing or Dating the FormRemember to sign and date the form, as any form without a signature is invalid. Incorrect AddressProviding an incorrect address may cause significant delays in processing paperwork. Always crosscheck to ensure the address you've provided is accurate. Choosing Wrong ExemptionEnsure that you understand all the exemption options before you make the wrong choice that leads to incorrect payments of taxes. Leaving Any Part UnfilledEvery section of the W-9 form is crucial. Leaving out any part incomplete may invalidate the whole process. Providing Incorrect Contact InformationEnsure your phone number and email address are accurate to avoid communication issues with your employer or the IRS. Not Keeping a CopyAlways ensure that you keep a copy of the form for future reference or in case of audit. To conclude, always double-check your W-9 form before submitting it. Seeing a tax professional for help if you're unsure about any part of the form is also a good idea. Fill Now -

![image]() Inaccurate W-9 Form & The Legal Implications The Internal Revenue Service (IRS) requires U.S. taxpayers to report their income accurately for taxation purposes. This typically involves completing a W-9 form. However, supplying incorrect information on this form can lead to various legal implications and penalties. This article aims to explain the potential legal consequences of inaccurate W-9 forms. What is a W-9 Form? A W-9 form is a document the IRS uses to manage income taxes for U.S. taxpayers who are independent contractors or freelancers. The company- or individual's responsibility is to complete and return this form accurately to the IRS and any relevant financial documentation. Legal Consequences of an Inaccurate W-9 form Submitting a faulty W-9 form can trigger various legal penalties, depending on the nature and degree of the inaccuracies. Nature of Inaccuracy Potential penalty Intentional disregard of rules and regulations The greater of $500 or 10% of the income you paid with the form for every incident. Falsification of tax identification number $500 penalty for each instance. Failure to supply a W-9 form 24% of the total income paid. Prevention and Correction of Inaccurate W-9 Form Precision is critical when completing a W-9 form to avoid these potential consequences. Ensure your tax identification number and personal details are correctly stated. Consulting a tax professional may prove beneficial to avoid inaccuracies and understand complex tax language. However, if you've already submitted a form with errors, you can amend this by submitting a new, correct form. Maintaining accuracy when completing tax forms prevents penalties and legal implications. The W-9 form, though seemingly straightforward, demands precision to avoid potential complications. Companies should consult with tax professionals and encourage contractors and freelancers to do the same. Despite the severe penalties, they serve as a reminder of the importance of truthful, accurate documentation in all tax-related matters. Fill Now

Inaccurate W-9 Form & The Legal Implications The Internal Revenue Service (IRS) requires U.S. taxpayers to report their income accurately for taxation purposes. This typically involves completing a W-9 form. However, supplying incorrect information on this form can lead to various legal implications and penalties. This article aims to explain the potential legal consequences of inaccurate W-9 forms. What is a W-9 Form? A W-9 form is a document the IRS uses to manage income taxes for U.S. taxpayers who are independent contractors or freelancers. The company- or individual's responsibility is to complete and return this form accurately to the IRS and any relevant financial documentation. Legal Consequences of an Inaccurate W-9 form Submitting a faulty W-9 form can trigger various legal penalties, depending on the nature and degree of the inaccuracies. Nature of Inaccuracy Potential penalty Intentional disregard of rules and regulations The greater of $500 or 10% of the income you paid with the form for every incident. Falsification of tax identification number $500 penalty for each instance. Failure to supply a W-9 form 24% of the total income paid. Prevention and Correction of Inaccurate W-9 Form Precision is critical when completing a W-9 form to avoid these potential consequences. Ensure your tax identification number and personal details are correctly stated. Consulting a tax professional may prove beneficial to avoid inaccuracies and understand complex tax language. However, if you've already submitted a form with errors, you can amend this by submitting a new, correct form. Maintaining accuracy when completing tax forms prevents penalties and legal implications. The W-9 form, though seemingly straightforward, demands precision to avoid potential complications. Companies should consult with tax professionals and encourage contractors and freelancers to do the same. Despite the severe penalties, they serve as a reminder of the importance of truthful, accurate documentation in all tax-related matters. Fill Now -

![image]() W-9 Tax Form & Retirement Planning Understanding the implications of W-9 forms and Social Security can assist in optimizing benefit payouts and retirement planning. If you are self-employed, a contractor, or operate an independent business, it's essential to understand how your W-9 information might affect your long-term planning and future benefits. W-9 Forms and Social Security The IRS Form W-9 is used by self-employed individuals or independent contractors. Rather than receiving a W-2 from an employer, these individuals must provide a filled W-9 to their clients, who will then issue a 1099-MISC form for tax purposes. One key area where this can have implications is the calculation and payout of Social Security benefits. Implications for Social Security The Social Security Administration calculates retirement benefits based on lifetime earnings. If you're self-employed or an independent contractor, you must report those earnings to the IRS and Social Security Administration through your tax return. Your reported earnings will play a direct role in determining your Social Security benefits. Impact on Retirement Planning The income you report on your W-9 can greatly affect your retirement planning. To ensure that you have a sufficient retirement fund, consider your projected Social Security benefits, your estimated expenses during retirement, and the income earned that you've reported via W-9. These factors combined give a comprehensive picture of your financial needs in retirement. A Closer Look: W-9, Social Security, and Retirement Planning Factors Description W-9 Information Details the income earned as a self-employed individual or independent contractor. Must be accurately reported to be reflected in Social Security calculations. Social Security Benefits Calculated based on lifetime earnings. Includes income reported via W-9. The higher the earnings reported, the higher the potential benefits. Retirement Planning Should consider projected Social Security benefits, estimated retirement expenses, and reported income via W-9. The balance between these elements can help determine the sufficiency of retirement funds. A W-9 form significantly impacts Social Security benefits and retirement planning. As an independent contractor or self-employed individual, it is incumbent upon you to understand these implications and ensure that your income reporting is accurate, for it can play a crucial role in your financial stability post-retirement. Fill Now

W-9 Tax Form & Retirement Planning Understanding the implications of W-9 forms and Social Security can assist in optimizing benefit payouts and retirement planning. If you are self-employed, a contractor, or operate an independent business, it's essential to understand how your W-9 information might affect your long-term planning and future benefits. W-9 Forms and Social Security The IRS Form W-9 is used by self-employed individuals or independent contractors. Rather than receiving a W-2 from an employer, these individuals must provide a filled W-9 to their clients, who will then issue a 1099-MISC form for tax purposes. One key area where this can have implications is the calculation and payout of Social Security benefits. Implications for Social Security The Social Security Administration calculates retirement benefits based on lifetime earnings. If you're self-employed or an independent contractor, you must report those earnings to the IRS and Social Security Administration through your tax return. Your reported earnings will play a direct role in determining your Social Security benefits. Impact on Retirement Planning The income you report on your W-9 can greatly affect your retirement planning. To ensure that you have a sufficient retirement fund, consider your projected Social Security benefits, your estimated expenses during retirement, and the income earned that you've reported via W-9. These factors combined give a comprehensive picture of your financial needs in retirement. A Closer Look: W-9, Social Security, and Retirement Planning Factors Description W-9 Information Details the income earned as a self-employed individual or independent contractor. Must be accurately reported to be reflected in Social Security calculations. Social Security Benefits Calculated based on lifetime earnings. Includes income reported via W-9. The higher the earnings reported, the higher the potential benefits. Retirement Planning Should consider projected Social Security benefits, estimated retirement expenses, and reported income via W-9. The balance between these elements can help determine the sufficiency of retirement funds. A W-9 form significantly impacts Social Security benefits and retirement planning. As an independent contractor or self-employed individual, it is incumbent upon you to understand these implications and ensure that your income reporting is accurate, for it can play a crucial role in your financial stability post-retirement. Fill Now