Tax Form W-9 Guideline for 2023

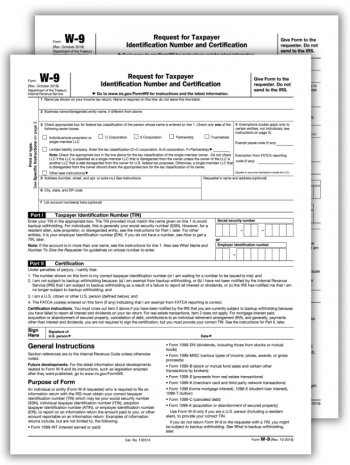

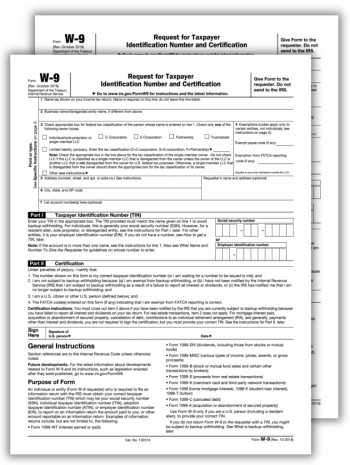

Engaging in financial interactions can feel like wandering through a tangled labyrinth, especially when confronted with paperwork like IRS Form W-9. This document is more manageable than it might first appear; consider Form W-9 to be something like a passport, your contractor's personal identification that the IRS needs to verify their tax situation. Essential for any non-employee service provider or freelancer, the free W-9 form in PDF allows them to provide their Taxpayer Identification Number to the entity they work with.

Free W-9 Form in a Few Clicks

If you're worried about handling this paperwork, there's good news. Our website, W-9-form-printable.net, can guide you through this financial maze, offering a wealth of resources at your fingertips. Here, you can for free download the W-9 form so you don't have to wait for a physical one. The website provides a free blank W-9 form, allowing you to fill it at your own pace and as many times as needed. Further, we provide expertly crafted instructions and user-friendly examples that serve as a beacon, making this task more comfortable and less likely to lead to a dead-end in our taxation labyrinth. Rest assured. Our website focuses on clarifying the navigation associated with tax forms, empowering users to explore the ever-complex world of financial paperwork safely.

The Assignment of IRS W-9 Form

The W-9 form is a legal document generally required by the United States Internal Revenue Service (IRS) to be furnished by contractors, freelancers, or anyone who has received certain types of income. This obligation is particularly relevant if you provided services equating to over $600 in any given year to a business as a non-employee.

Consider a Case

- To give you a more tangible grasp of this subject, consider a fictional character named Steven, a freelance graphic designer. Steven spent the past year designing multiple websites and logos for a local marketing agency, yielding a total income of $10,000. So, he's not a regular marketing agency employee, and his income well surpasses the $600 limit. That's why Steven must obtain a free printable blank W-9 form and provide a copy to the employer.

- Steven's worries about managing this document were eased when he discovered a free W9 form online on our website. He filled it out with his necessary personal and tax identification information. The process was straightforward, markedly decreasing the hassles of tax obligations, and Steven could continue focusing on his design projects without further ado. Remember, a free W9 tax form is easily accessible and streamlines your taxation process, just like it did for Steven.

To correctly complete a free printable IRS W-9 form without errors, an individual must follow a series of steps conveniently broken down using this platform.

Free Printable W-9 Form: Filling Instructions

- Firstly, you'll need to download and print the W9 form for free directly from the website. Picture this as breaking ground, ready to construct your financial blueprint.

- For those who prefer digital convenience, a free W9 fillable form for 2023 is available as well. Consider this the digital upgrade for your financial planning toolbox.

- As your next step, you'll enter your full name and business name (if applicable) into the requested fields. Following this, you'll indicate your tax classification and provide your address. Pretend you're giving directions to a friend visiting for the first time, but this time, it's to the IRS.

- In the next step, we move into more significant detail - your TIN or SSN. Keeping a careful focus on each digit as though it's a pin code to your valued treasure box can ensure accuracy here.

- The final steps involve signing and dating the form.

Due Date

For those who find tax forms perplexing, the free printable W-9 form for 2023 is available for US taxpayers' ease. The W-9 tax form has no specific due date; it is requested by a third party when they need your Taxpayer Identification Number.

Form W-9 & IRS Penalties

You may now wonder why there's no fixated deadline. This is because the W-9 form is not submitted to the IRS like other tax forms but rather given to someone who must make a report to the IRS. The requester typically asks for it at their earliest convenience or when they reasonably expect a reportable payment, hence the absence of a firm due date. Make sure not to forget this registered taxpayer responsibility and steer clear of IRS penalties.

- Incorrect Information

Providing false or misleading information in a free W-9 fillable for 2023 is another crucial issue. Think about it as providing incorrect directions to a driver - it leads to confusion, wasted time, and, in this case, legal trouble. - Not reporting a changed Taxpayer ID

If you've changed your tax ID and should have reported it, this could result in fines. It's like changing your address and not telling your pen pal; they'll keep sending letters to the wrong place!

Our Advice to Employers

Obtain the free fillable W-9 form for 2023 to send to contractors you work with. So you can always be sure you'll not receive the old or incorrect copy. Similar to keeping your study clean, it helps to have everyone's tax information readily available and organized.

Federal Form W-9: Questions & Answers

- How can I obtain the W9 form for 2023 (printable) for free?To obtain a W-9 for print, simply head to the designated section of our website. There, you'll find a link to download the document for free. After downloading, you can print it out and use it as needed.

- Does your website provide a free W9 online form in 2023?Yes, you can access the fillable PDF for free using our website. You can easily download this file and fill it out electronically. It's a convenient option for those who prefer to handle their paperwork digitally.

- What if I use the online template instead of the free W9 form for print?If you prefer the online template instead of the paper copy, that's perfectly fine. Our website offers this option; you can fill out the PDF directly on your computer or mobile device. After completion, you can save it, print it, or email it directly.

- How much time do I need to complete the free printable W-9 tax form?The time it takes to complete the request for TIN can vary depending on your familiarity with the form. Generally, it takes about 5-10 minutes to complete the necessary sections properly. Ensure you set enough time aside to complete it carefully and accurately.

- What mistakes do people make when filling out the free W-9 form printable?Some common mistakes include entering incorrect TINs or mismatched names and numbers. Others need to complete all required fields or fill the template out illegible, which can cause difficulties during processing. Always double-check your work to avoid errors.

Free W-9 Tax Form: Related Articles

-

![image]() Free Printable W9 Form With the new fiscal year in the offing, businesses and independent contractors are often faced with timely tax preparation. One of the most pivotal forms to understand and correctly fill out is the W9 form – an inherent cog in the wheel of the IRS taxation mechanism. Designed to ensure proper... Fill Now

Free Printable W9 Form With the new fiscal year in the offing, businesses and independent contractors are often faced with timely tax preparation. One of the most pivotal forms to understand and correctly fill out is the W9 form – an inherent cog in the wheel of the IRS taxation mechanism. Designed to ensure proper... Fill Now -

![image]() Free W9 Form for 2023 The concept of taxes can often seem tangled in a web of complexity. But, like any enigma, it unravels when taken one step at a time. A good starting point is understanding Form W-9, an essential document in the US tax scheme. In this article, we will explore the ins and outs of the W9 form for 2023... Fill Now

Free W9 Form for 2023 The concept of taxes can often seem tangled in a web of complexity. But, like any enigma, it unravels when taken one step at a time. A good starting point is understanding Form W-9, an essential document in the US tax scheme. In this article, we will explore the ins and outs of the W9 form for 2023... Fill Now -

![image]() Free W-9 Tax Form Wading through the labyrinth of US tax forms can be daunting, but understanding the right form to use can make a world of difference to your pocket. One such example is the W-9 tax form. The Basics of the W-9 Tax Form The Internal Revenue Service (IRS) designed the free printable W-9 tax form for... Fill Now

Free W-9 Tax Form Wading through the labyrinth of US tax forms can be daunting, but understanding the right form to use can make a world of difference to your pocket. One such example is the W-9 tax form. The Basics of the W-9 Tax Form The Internal Revenue Service (IRS) designed the free printable W-9 tax form for... Fill Now -

![image]() Free Fillable W9 Form Starting with a concise explanation, the IRS W-9 Form is utilized by employers to request a taxpayer's identification number and certification. It's a critical document primarily used for self-employed contractors or freelancers. The offeree should aim to fill it accurately to avoid potential penalt... Fill Now

Free Fillable W9 Form Starting with a concise explanation, the IRS W-9 Form is utilized by employers to request a taxpayer's identification number and certification. It's a critical document primarily used for self-employed contractors or freelancers. The offeree should aim to fill it accurately to avoid potential penalt... Fill Now